The idea of UPI was brought to India to take Digital India further and promote Cashless India. Today in this article, I am gonna talk about UPI full form, what is UPI and how to use UPI or what are the best apps to use UPI in India 2021. So let’s begin.

There was a time when we had to go to the bank to send money to someone else’s bank account. But gone are those days. Now we can send money to someone else’s bank account in a very short time through various methods sitting at home.

There are different money transfer methods that we can use to transfer bank balance to another person account in a quick time such as NEFT, RTGS, UPI, IMPS etc. But among all these options UPI is the easiest and quickest one. In India, UPI was rolled out in the year 2005.

We can use UPI through various apps like PhonePe, Google Pay, Amazon Pay etc. We can also use BHIM APP and various banks own UPI apps like SBI has its own app called YONO SBI.

What is UPI

UPI is an advanced mode of banking payments. With the help of UPI, we can easily send money to someone else’s bank account or request money from their bank account.

For this, first of all, we have to create a UPI ID and UPI PIN. And then we can send money to anyone with that UPI ID and PIN.

Different banks have some different rules of UPI. Almost all the banks have made UPI Transaction Free but there are many banks in which we have to pay a charge for UPI transactions.

Also in most of the banks like SBI, Paytm, PNB etc. we cannot do more than 10 UPI transactions in a day. Also through UPI, we cannot send more than 1Lakh rupees in one day.

If we ever need to send someone more than 1 lakh or buy something worth more than 1 lakh, then it is better to use a debit card or credit card.

UPI Full Form

| Short-Form | Full-Form |

|---|---|

| UPI | Unified Payment Interface |

| BHIM | Bharat Interface For Money |

| NEFT | National Electronic Funds Transfer |

| RTGS | Real-Time Gross Settlement |

| PSP | Payment Service Provider |

| VPA | Virtual Payment Address |

| mPIN | Mobile Banking Personal Identification Number |

In India, UPI was introduced for the first time in the year 2005. UPI full form is Unified Payment Interface. We can use UPI in different payment apps. But we should know the apps well before we use these apps.

Some popular UPI apps are PhonePe, Google Pay, Amazon Pay, BHIM, Paytm etc. These UPI Apps are very safe and we get a lot of cashback for using UPI in them.

These UPI apps are very safe and we also get a lot of cashback for using UPI in these apps. We can also get cashback by joining our friend’s in these UPI Apps if we want.

How To Use UPI

We can do online transactions in different ways like debit cards, credit cards, UPI, Wallet, NEFT, RTGS etc. We can do everything from PC, Mobile or Laptop. But UPI we can only do from our smartphone. We can’t use UPI without a smartphone.

To use UPI, first of all, we have to create a UPI ID and UPI PIN. Just as our bank account number is unique, so is our UPI ID is also unique and that is the identity of our bank account number.

To send money to anyone through UPI, we all have to open a UPI App first and then enter that person’s UPI ID. Then the UPI ID of the person whose name is shown in front of us so that we do not send money to anyone else. Then we have to enter the amount and the UPI PIN and thereafter the money goes to that person account.

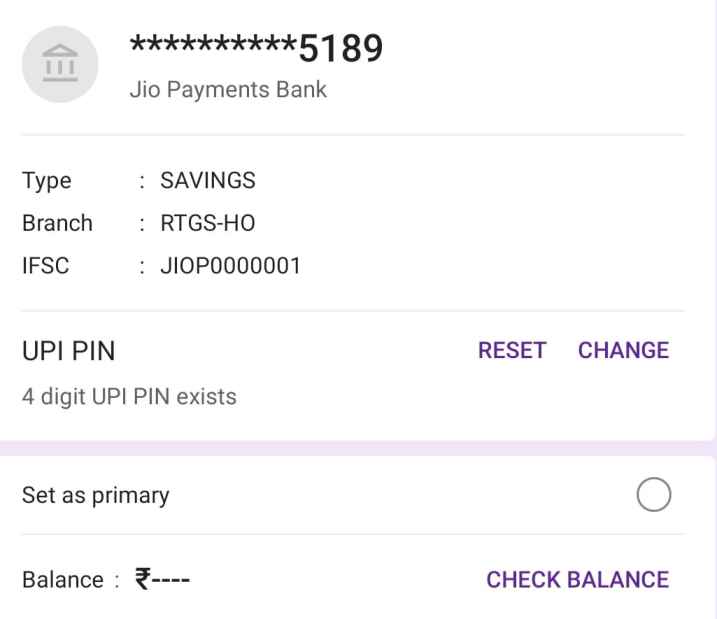

SBI has 6 digit UPI PIN whereas Paytm Payments Bank and Airtel has 4 digit UPI PIN.

What is VPA in UPI

VPA full form and UPI full form are completely different. But both of these two terms are the same. VPA stands for Virtual Payment Address whereas UPI Full Form is Unified Payment Services.

We have to first create a UPI ID or a VPA to send or receive money from someone’s account. UPI ID or VPA helps us to send or receive money from someone else account without knowing his or her bank account number and account details. That’s why UPI is very popular in India.

What is mPIN in UPI

UPI PIN and mPIN are completely two different things. UPI PIN is used to send money with the help of UPI. Whereas mPIN is a passcode that is used to make any kind of payments like IMPS, NEFT etc. The full form of mPIN is UPI is Mobile Banking Personal Identification Number.

How To Create UPI ID

Before creating a UPI ID, we need a bank account and a debit card. Also, if we are not 18 years old, we will not be able to create a UPI ID. We can create a UPI ID through any Apps like PhonePe, Google Pay, Amazon Pay, BHIM, YONO SBI, Paytm etc.

- First of all, download any Bank UPI App or any payment apps like Paytm, BHIM, Google Pay, PhonePe, Amazon Pay etc.

- Choose your preferred language. And then add your Mobile Number and verify it.

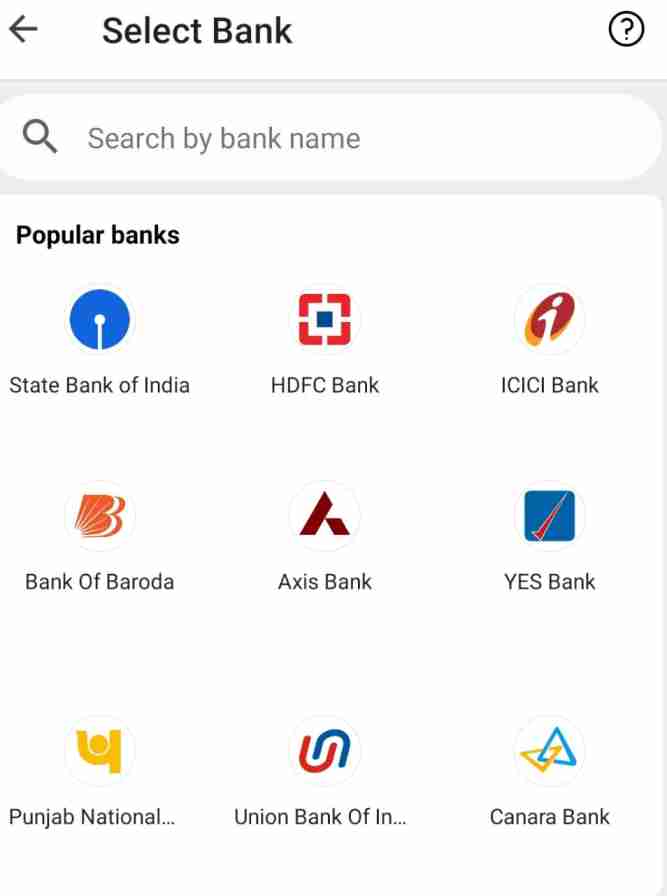

- Then select your Bank Account or search your Bank name.

- Now create your profile by adding your name, virtual ID, password etc.

- Add your Bank Account and create mPIN.

- Once you have done this your registration will be confirmed.

- Now you can send or receive money with the help of UPI to anyone.

Add Bank Account in UPI App

- Open any UPI based payment app on which you want to add a bank account.

- Search the Bank Account option from the available tab.

- Add Bank Account.

- Search or add bank account from available options.

- Set UPI PIN by entering Debit Card last six-digit, expiry date and month and OTP linked with mobile number.

- Create your six or four-digit UPI PIN.

- Done!! Your bank account has been linked with the UPI app.

How To Change UPI PIN

- Open UPI App and then find the Bank Account tab.

- Select the Bank account and then tap on Change UPI PIN.

- Now enter the last six digits of your Bank linked Debit Card, expiry month and year and OTP.

- Enter new UPI PIN.

Reset UPI PIN

- First of all, open UPI App.

- Tab on Bank account tab.

- Select the Bank account and then tap on Reset.

- Enter Debit/ATM Card Details.

- Enter last six digit of your card number.

- Thereafter fill the valid up to sections with debit card expiry month and year.

- Finally, enter OTP and new UPI PIN.

Best UPI Apps in 2021

| UPI Apps | Referral Bonus |

|---|---|

| 1. Google Pay | ₹150 in Bank |

| 2. PhonePe | ₹125 in Wallet |

| 3. Paytm | ₹150 in Bank |

| 4. Amazon Pay | ₹25 in Wallet |

| 5. BHIM | NIL |

Advantages and Disadvantages of UPI

| Advantages of UPI | Disadvantages of UPI |

|---|---|

| 1. UPI is a very fast and secure payment option. | 1. We can’t use UPI on PC or Laptop. |

| 2. We don’t have to pay any transaction charges to transfer money through UPI. | 2. We have to carry our smartphones with us to send or receive money at any place. |

| 3. There is no minimum limit for UPI. | 3. Different banks have different rules. Like in SBI the maximum transaction limit is 1Lakh per day whereas for Bank of Baroda the maximum transition limit is 50,000 per day. |

| 4. We can send money from UPI within one click. | 4. If we forget UPI PIN then we can’t send money through UPI App. |

| 5. We have a chance to earn cashback through different UPI apps. | 5. To transfer UPI money, we have to keep SIM cards linked with our Bank Account in our smartphones all the time. |

| 6. No one else can know our bank account information if we transfer money through UPI. | 6. To receive money through UPI someone needs to register and download UPI apps on their phone. |

| 7. In case, if we enter the wrong UPI PIN multiple times then our transaction will be cancelled and the bank will temporarily block our account. | 7. If someone knows our UPI PIN then they can send money to someone else with our smartphone. So we should keep our UPI PIN secret. |

I hope you read this article till the end to know UPI Full Form, What is UPI and it helped you to know a lot of information related to UPI. If you have any questions then please comment below. You can also contact us on Instagram or YouTube.

FAQs: UPI Full Form

The full form of UPI is Unified Payment Interface

The full form of VPA is a Virtual Payment Address.

VPA is your UPI ID you can find it in your UPI app.

Yes, UPI is completely Safe.

The maximum transaction limit on UPI is 1 Lakh.