There was a time when we had to stand in line at the bank or post office to send money or transfer money to someone. But now there are many best money transfer apps in India available that we can send money to anyone sitting at home.

Today I will tell you about the 10 best money transfer apps in India that I use for myself. Not that there are no more apps than these 10 UPI payment apps to send money instantly. You can use any UPI payment app if you want to make an online money transfer from one bank to another bank. These apps include the Bank’s own app like SBI’s YONO or BHIM SBI Pay, Axis Bank’s BHIM Axis Pay, BOI Bank’s BHIM BOI Pay etc. You can download any UPI payment app and send money from any bank to another bank.

With these apps, you can easily transfer or send money from your bank to another bank, your bank to another bank and also load money to your wallet.

So let’s take a look at these top 10 best money transfer apps in India 2024 list. Read all the details of these apps and choose the best UPI app to send money instantly to you.

10 Best Money Transfer Apps List

| Best Money Transfer Apps | Referral Bonus | Download Link |

|---|---|---|

| 1. Google Pay | ₹201 | Click Here |

| 2. PhonePe | ₹100 | Click Here |

| 3. Paytm | ₹100 | Click Here |

| 4. BHIM | ₹100 | Click Here |

| 5. MobiKwik | ₹20 | Click Here |

| 6. Airtel Thanks | ₹150 Bill Discount | Click Here |

| 7. YONO SBI | ₹150 | Click Here |

| 8. My JIO | – | Click Here |

| 9. Freecharge | – | Click Here |

| 10. Amazon | ₹21 | Click Here |

1. Google Pay App

It is one of the most downloaded money transfer apps on Android and iOS devices. Previously its name was Tez but last year its name is Google Pay.

Google Pay is the most loved and used money transfer apps in India. It has many reasons. You can transfer money from all banks. Google Pay also comes with a referral offer. If you refer someone and if they join make a UPI money transfer for the first time through your referral link then you will get ₹201 cashback in your Bank. Yes, you heard it right. Google Pay will deposit your cashback directly into your linked bank account. There is no wallet option in this app. The user who will join through your link will also get ₹21 in their bank too.

We can make Bank transfers, UPI money transfers, QR codes and self-bank transfers on this money transfer app. Not only this, we can recharge our mobile, DTH, electricity, cable, gas, landline, water and a lot more types of online payments from this app. You can link more than one bank account in this app. Google Pay is a best app to send money instantly.

Another reason for the Google Pay App so much success in a short period of time is the scratch card offer. Yes, it is true maximum time you will get a ‘better luck next time scratch card. But sometimes you will get cashback, rewards for money transfers, recharge, and bill payments through Google Pay.

How To Send Money Through Google Pay

- Launch the Google Pay App.

- Tap on ‘New Payment’.

- Select any option from the Bank Transfer, UPI ID or QR options.

- Enter Bank details or UPI ID details.

- Enter the amount and then make payment through UPI ID.

- See the rewards section to check earned scratch cards.

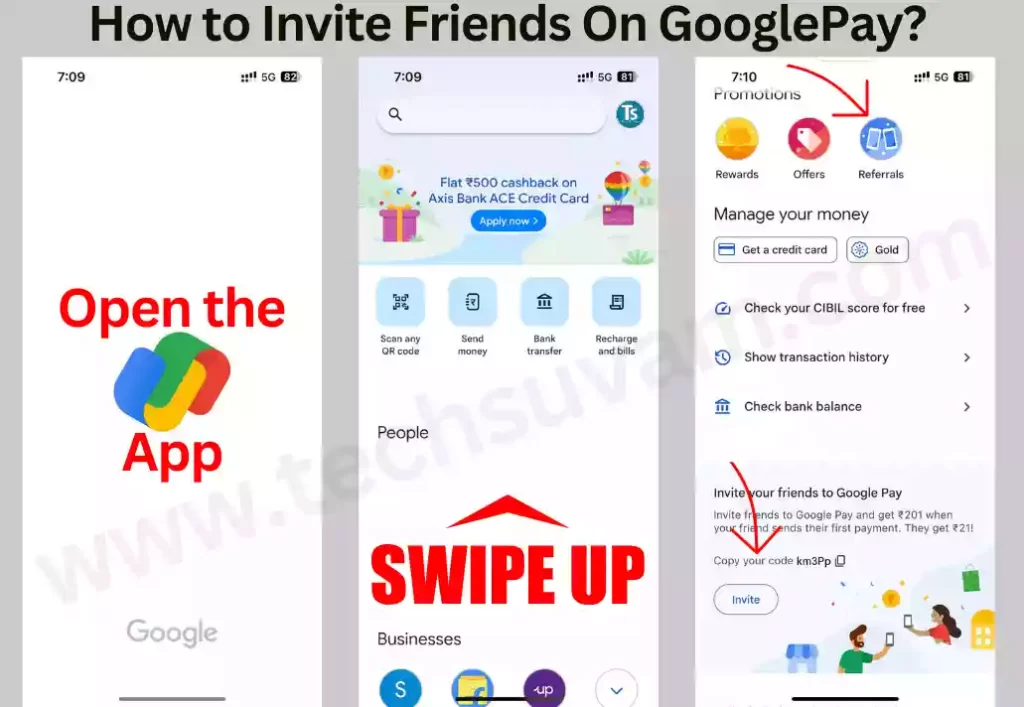

Google Pay Referral Offer

There is no fixed referral system in Google Pay. Sometimes you will get ₹201 cashback, 150 cashback or even sometimes you will get ₹175 cashback. So it is a user-specific offer. the person who will register through your link will also get ₹21 in their bank account.

- First of all, update and open the Google Pay app.

- Scroll down and tap on any of the Offers, Invite or Referral sections.

- Share your Google Pay Invite Link with friends on social media.

- Ask them to join through your link and make their first UPI payment.

- After their 1st successful UPI money transfer, you will receive ₹201 cashback in your bank. And the new user will also get ₹21 cashback in their bank account too.

Also Read: How to Close Airtel Payment Bank Account

2. PhonePe

The second money transfer app that I am gonna tell you about is the PhonePe App. From UPI, Bank transfer, add money to referral, ticket booking, recharge, bill payment, DTH, investment, digital gold and a lot more every type of online transaction can be done on this app.

Users send money to their friends, relatives or anyone up to 1lac every day. You can link more than one bank account if multiple accounts are linked with the same mobile number.

PhonePe provides cashback and rewards for each transaction made through the PhonePe App. You can send money from Rs 1 to any individual who has an Indian bank account.

How To Send Money Through PhonePe

- Open the PhonePe App.

- Tap on any option between the ‘To Contact’, ‘To Account’, or ‘To Self’ options.

- Add Recipient Bank Account or UPI ID.

- Enter Bank Account Number, IFSC Code, and Beneficiary Name.

- Then enter the amount and make payment through UPI.

Also Read: How To Delete Transaction History in PhonePe

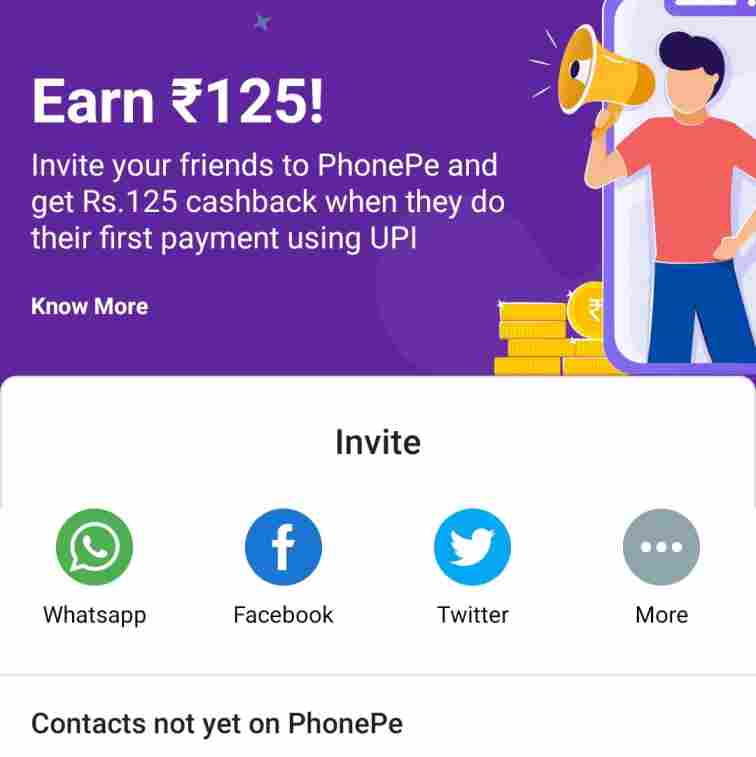

PhonePe Referral Offer

If you refer someone to PhonePe, then you will get ₹100 cashback in your PhonePe wallet. You can transfer your wallet balance to a bank account or even use it to recharge, pay bills, shop etc.

- First of all, launch the PhonePe App.

- Tap on the ‘Refer & Earn ₹100’ option.

- Share your PhonePe invite link through WhatsApp.

- Once they sign up through your link and make a UPI payment, they will receive ₹100 cashback in their PhonePe wallet.

Also Read: How To Order PhonePe Sound Box

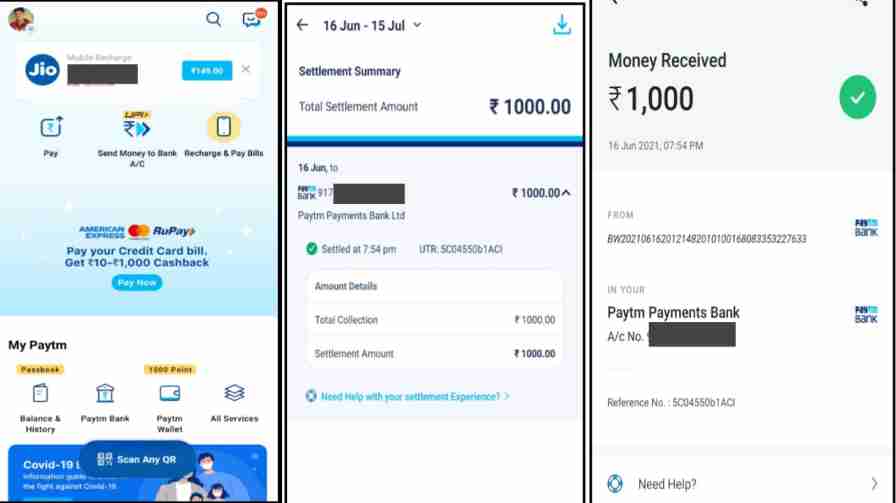

3. Paytm App

From recharge, bill payments, DTH, ticket booking, and money transfer to shopping, digital gold, investment, loans everything we can do from Paytm App. Paytm is the most loved and easy-to-use money transfer app in India.

Anyone can transfer money from one bank to another easily through Paytm. We can transfer from wallet to Bank account and from bank to wallet too. Paytm has its own Payments Bank too.

Paytm also runs a referral offer. If you will refer your friends then you will get ₹100 cashback in your Paytm wallet.

How To Bank Transfer Via Paytm

- First of all, launch the Paytm App.

- Tap on ‘Send Money to Bank A/C‘.

- Now select the ‘To Bank Account option and enter your Bank details.

- Enter the amount and make payment through UPI.

Also Read: How To Increase Paytm Postpaid Limit

4. BHIM UPI App

This is an official UPI payments app. You can you this app to make an online money transfer through UPI. The best part of this money transfer app is you can use it in any Indian language. BHIM App supports QR Code Scan & Pay, creating or resetting UPI PIN, transferring money through UPI etc. Apart from this, we can save beneficiary or contact details on this app, and check transaction history.

There is no invite and earn option on this app. So you won’t get any cashback or offer for downloading the BHIM UPI App. As far as the user interface is concerned, I think the BHIM UPI App is the best app to send money instantly. If you are looking for an app that can be used only for making online payments then BHIM UPI App will be a great choice for you.

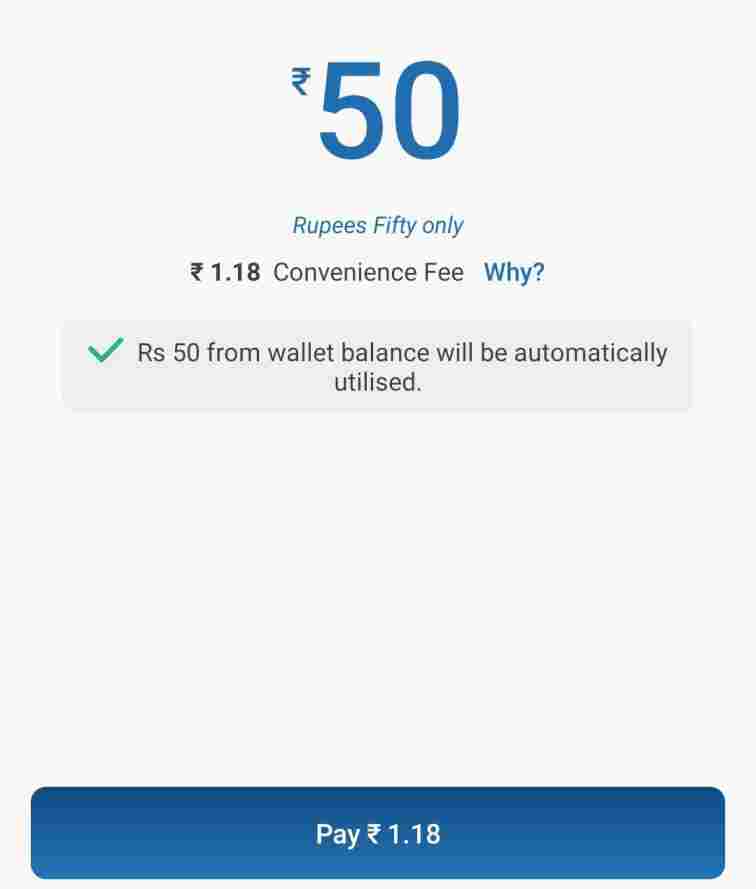

5. MobiKwik

I feel MobiKwik is also a similar kind of app to Paytm, Airtel Thanks, PhonePe, and Google Pay. Yes, MobiKwik does not have any payment bank but still, it is one of the best money transfer apps that I have ever used in my life.

We can make bank transfers, UPI payments, wallet to a bank transfer, add money to our wallet, scan any QR and a lot more types of online transactions through the MobiKwik App.

MobiKwik runs different types of cashback offers on money transferring and referral. If you will refer your friends then you will earn cashback in your MobiKwik wallet too.

How To Transfer Money Via MobiKwik

- First of all, launch the MobiKwik App.

- Tap on ‘Bank to Bank Transfer‘.

- Enter your Name, Mobile No or UPI ID.

- Enter the amount and make payment through UPI.

- Also, you can transfer to your own account too.

6. Airtel Thanks App

It’s an official payment application from Airtel. We can do different types of online payments. Airtel launched the first payment bank in India. Anyone can open an Airtel Payments Bank like Paytm Bank.

You can use this app to transfer money from one bank to another, UPI, recharge, bill payments, DTH, broadband and a lot of types of online payments. We can make UPI money transfer from any Indian bank that supports UPI.

How To Send Money Through Airtel Thanks

- Firstly, launch the Airtel Thanks App.

- Tap on BHIM UPI or Scan any QR.

- Enter your UPI ID and then enter the amount.

- Make payment by entering your UPI PIN.

Airtel Thanks Referral

- You will get ₹150 discount coupons.

- Airtel Thanks postpaid referral program is a simple 3-step process.

- Share your referral link.

- Your friend clicks on the link and completes the process.

- Airtel agents will visit your friend and complete the activation.

- After that, both of you receive ₹150 discount coupon on Airtel Thanks.

7. YONO SBI

This is an official application for SBI customers only. You can not use this app if you don’t have an SBI bank account. But in case, if you are an SBI Bank customer then you can use this app. YONO SBI comes with a very good interface. You will make all kinds of things related to SBI in this app.

From checking bank balances, account statements, debit or credit card applications, money transfer to FD, nominee change and a lot more things can be done through this app.

How To Transfer Money Through YONO SBI

- Launch the YONO SBI App.

- Tap on Quick Pay and enter your 6-digit PIN.

- Now choose the beneficiary option and add beneficiary details.

- Enter beneficiary name, Bank A/C no, IFSC Code etc.

- Enter the amount and make payment.

- Also, you can transfer money through the YONO Pay or the BHIM UPI option directly.

8. My JIO

My Jio has recently added a UPI option to this app. Previously we had an option on Jio Money to send money from one bank to another bank. You can transfer from all bank accounts through Jio UPI.

We can access a lot of things from the My Jio App. We can recharge our mobile numbers, check Jio data balance, money transfers and access every Jio app in one place.

You can create your UPI handles and send money, make bill payments or pay via QR code safely from My Jio UPI.

How To Transfer Money From My Jio UPI

- Launch the My Jio App.

- Tap on Jio UPI.

- Now choose ‘Let’s get started’.

- Enter your Mobile Number and verify it with OTP.

- Once verification is completed, enter the UPI PIN of any user.

- Enter the amount and make payment through UPI Pin.

9. Freecharge

It has been one of the most popular recharge and bill payment apps in India for a long time. Freecharge allows us to send money through UPI easily. In this app, we can get cashback offers on a lot of platforms. Apart from online money transfers, we can pay later, buy stocks or mutual funds, rent payments, and digital gold on this app.

If you shop on Amazon through Freecharge or pay electric bills through Freecharge then you will get cashback too.

Send Money Through Freecharge

- First of all, download the Freecharge App.

- Register on this app and open it.

- Tap on UPI Send Money.

- Verify your Mobile Number and tap on Next.

- Once verification is completed, you will get to see a Congratulations message.

- Again, tap on Link Your Bank Account.

- Search your Bank Name and link it with Freecharge.

- Now enter BHIM UPI ID or Bank A/C Name, IFSC Code, and Beneficiary Name to send money.

- Enter the amount and then make payment by entering your UPI PIN.

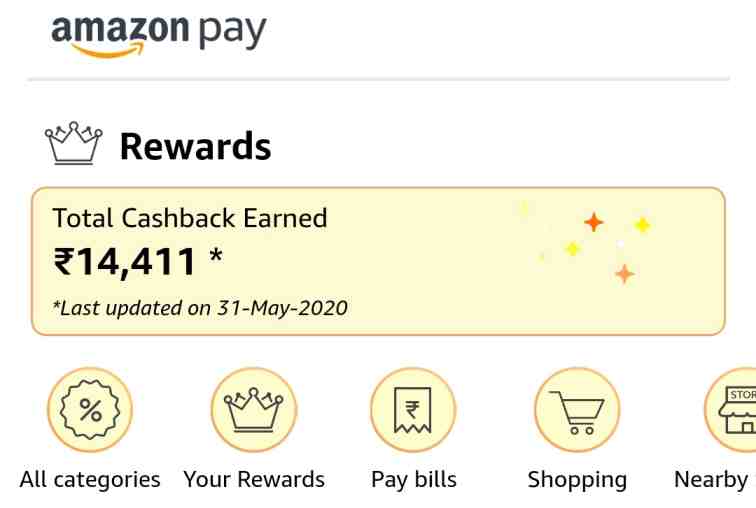

10. Amazon App

Many people know that Amazon is an app that we can use to send money or check our bank account balance. Apart from shopping, we can use this app to recharge, pay bills, ticket booking and do a lot more things through this app.

The reason many users love to use this app for online money transfer, recharge and bill payment is that Amazon has a lot of cashback offers for new and old users.

Transfer Money Via Amazon App

- First of all, open the Amazon App.

- Log in with your account and link your Bank on this app.

- Tap on Send Money.

- Enter UPI ID or Bank Account details (Bank Account Holder Name, IFSC Code, Account Number).

- Tap on Proceed to Send Money.

- Enter the Amount and UPI PIN and make payment.

FAQ: Online Money Transfer App

All the UPI money transfer apps are good. People use it according to their choices. The purpose of every app is to send money from one bank to another. Most people prefer PhonePe or Google Pay because we get cashback for money transfers and referrals on these two apps.

UPI full form is Unified Payment Interface. It allows us to make payments instantly from one bank to another. There is no minimum limit. The maximum we can transfer is 1 lac.

A UPI PIN is a 4-6 digit UPI PIN that allows us to make payments. MPIN and UPI PIN are two different things. Please don’t share your UPI PIN with your close ones.

Yes, you can link more than one bank account to the same virtual address. If you wish you can make payments from any linked bank account you want.

There is no minimum limit for UPI money transfers. The maximum you can transfer every day is 1 lac.

Paytm, PhonePe and Google Pay are the three best UPI money transfer apps that I have ever used in my life. As far as the cashback offers are concerned, as of now, Google Pay is the best app that provides you with cashback offers along with scratch cards for every transaction you make.

Final Thoughts (App To Send Money Instantly)

So, you read the article and you have a list of 10 best money transfer apps in India 2023. The apps that I have mentioned above are the best in the market and you can blindly trust them. If you ask me to choose the top 3 apps from the above-mentioned money transfer apps in India then I will say Google Pay, PhonePe and Paytm are the three best apps to send money instantly. Whenever I need to send money to someone I use Paytm or Google Pay.

Some of the above-mentioned apps to send money instantly come with referral offers. It’s like some free money which you can recharge or bill payments for yourself or your family. But it does not mean I am recommending you download only those apps that give the highest referral offers to send money instantly.

In the above-listed 10 best money transfer apps in India 2023, I have included some apps that are purely bank-specific apps or government apps. So, the trust and safety are always there. But what I feel is if you use popular apps to send money instantly like Paytm, PhonePe or Google Pay then you can send money instantly without any issue as per my experience. I hope you understand my points and what I am trying to say. For any queries or doubts please comment below. Thank You.