If you are an Upstox user and looking for How To Buy SGB in Upstox, then this article is for you. As you know Upstox has two mobile apps apart from the web version. So with too many challenges for different Upstox platform users. But don’t worry here we will share all the methods to Buy SGB in Upstox 2024 for every type of Upstox User.

SGBs or Sovereign Gold bond is one the best investment options that one should consider. Since it’s backed by the government itself it’s also considered as one of the safest investment options. The SGB Scheme was first launched in 2015 under the gold monetisation scheme. This investment option comes with multiple benefits. With SGB you can enjoy returns of Gold along with 2.5% annual interest. Aside from that, there is a complete exemption from capital gains tax upon redemption.

Also Read: Best Apps to Invest in US Stocks From India

How To Buy SGB in Upstox Mobile New Version?

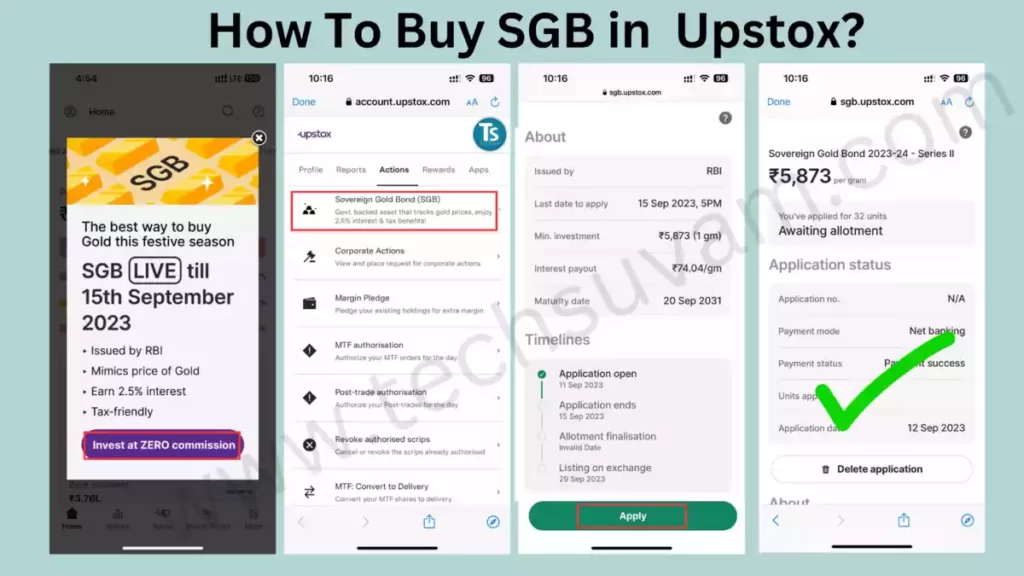

To Buy SGB from Upstox you will need to follow these steps.

- First of all login into the Upstox account using your credentials.

- If there’s any active SGB series available then you will see the SGB banner on the Homepage, Simply click on that.

- If the banner doesn’t show on your device then you have to head over to the Actions section. first of all, simply visit to Profile section and then My Account>Profile>Actions.

- Now Choose the “SGB” option from Actions.

- Select the “Apply option” and Enter the Units. 1 SGB Unit Denotes 1gm Gold and you can buy max 4000 units at a time.

- Click Continue and finally Select the payment method like Netbanking and UPI. If you are investing more than 2lakh then select net banking.

- After the “Demat Transfer Date” you will able to see the SGB units in your investments section.

Also Read: How To Delete Upstox Account Permanently

How To Buy SGB in Upstox Old Version?

If you are still on the Upstox Old version then the process is slightly different. Here are all the steps you will have to follow To Buy SGB in the Upstox Old Version:

- First of all log in to the App and then head over to the “Investment” option from the bottom bar.

- Now Click on “Apply SGB” on that page.

- After that, you can see all the details about SGB like the timeline, and minimum investment. In this, you can see the “Apply” tab simply select that.

- Enter the number of units you wish to buy and simply complete payment using UPI or Netbanking.

How To Buy SGB on Upstox Web?

- To Begin with, you will need to log in to Upstox Web using your Phone number or QR Code.

- Now on the top dashboard, you will see the “SGB” option simply click on that.

- Now you can see all the details about this SGB issue just like the app version, simply select the “Apply” option.

- Finally, Enter the number of units you need to invest and then complete the payment.

Also Read: Groww Vs Zerodha Vs Upstox

How To Cancel SGB Order in Upstox App?

To Cancel the SGB order in Upstox you will need to visit the SGB investment page.

- First, head over to the Profile section and then My Account>Profile>Actions.

- Now Select the SGB option.

- Now Click on “Delete Application” and then hit Confirm.

Things to Know Before Investing in SGB

- The SGB Scheme Comes with a Sovereign Guarantee.

- The Price of SGB is like the gold price so your investment value will be moved as per the gold price.

- Aside from investment moving according to gold price, the investor will also receive a 2.5% interest rate.

- Unlike Physical gold with SGB, you don’t have to worry about making charges or getting stolen.

- In Digital gold we have to bear GST on purchase and sell but not with SGB.

- SGBs are also free of Brokerage, STT and GST as with gold ETFs, both at the time of purchase and sale.

- You can also get a Rs 50/g Discount if you purchase online.

- SGBs have a maturity period of 8 years, but you can redeem them anytime after the 5th year.

Also Read: Best Zero Brokerage Demat Account in India

FAQs: How To Buy SGB in Upstox 2024

The price of SGB units depends on the market price of gold. So if the Gold price declines your investment value will also decline.

You can buy up to 4000 units for every new issue.

No, TDS doesn’t apply to SGB investment.

Yes, it can used as collateral for loans for banks and NBFCs.

SGB Interest is credited to investors’ bank accounts Semi-annually.

You can find the issue date of the latest SGB Scheme on RBI’s official website.

No, you cant Purchase SGB using Upstox wallet Balance.

Conclusion

So that was about how to buy SGB in upstox. We tried to cover all the processes for different types of upstox users. We think SGB are really good investment option that one should consider. It will not only provide the same as gold return but also give 2.5% interest. Apart from this, there are no additional charges involved with this scheme like other gold investments or equity investments.

Nevertheless, SGBs also have negative things. One of the major drawbacks with SGBs is that they come with a 5-year lock-in period so you can’t exit before the time frame. To get capital gains tax benefit you will need to stay invested for 8 years. Hope this article helps you in your investment.

Disclaimer

The investment options and stocks mentioned here are not recommendations. Please go through your due diligence and conduct thorough research before investing. Investment in the securities market is subject to market risks. Please read the Risk Disclosure documents carefully before investing. Past performance of instruments/securities does not indicate their future performance. Due to the price fluctuation risk and the market risk, there is no guarantee that your investment objectives will be achieved.

Also Read: How To Open Demat Account in HDFC