Nowadays anyone can trade from home with their Smartphones. Trade is when someone buys shares of a company. You can easily buy and trade shares of a company. Today from this article you will know about the 10 best trading apps in India 2024. With these stock market trading apps, you can easily buy shares of any company. After some time if you get a good profit then you can sell shares and earn a good profit from it.

There was a time when we had to take the help of a stockbroker for stock trading. But now that day is no more. Now you can easily trade with the help of the best trading apps in India.

You have to pay some charges (AMC Charges) but I feel Stock Market Trading through mobile apps helps us a lot. It saves our time thus we can research better and invest our money. These best trading apps in India 2024 come with a clean and easy to understand interface, zero brokerage fee, and paperless and fastest Demat account opening.

10 Best Trading Apps in India To Earn Money

| Trading Apps | Referral Commission | App Link |

|---|---|---|

| 1. Upstox | ₹200 | Download Now |

| 2. Groww | ₹100 | Download Now |

| 3. Paytm Money | ₹300 | Download Now |

| 4. Zerodha | 10% Commission | Download Now |

| 5. 5Paisa | 40% Commission | Download Now |

| 6. IIFL Markets | ₹500 Voucher | Download Now |

| 7. ShareKhan | 15% Commission | Download Now |

| 8. SBI Securities | ₹750 Voucher | Download Now |

| 9. Angel Broking | ₹750 Amazon Voucher | Download Now |

| 10. HDFC Securities | ₹500 Gift Voucher | Download Now |

1. Upstox Pro Trading App

If you are looking for the best trading apps in India 2024, then you can check out our Upstox App Review article. I feel Upstox is the best trading app in India. It has a lot of reasons. Let me tell you. Upstox Pro will help you trade in shares, F&O, equity derivatives. Previously its name was RKSV Securities but now it’s known as Upstox Pro. It comes with a web version (pro web platform) and a mobile app for all users.

Here you can check the top 20 market caps in the Watchlist tab. Multiple shares will be shown here. You can choose any of the shares and buy them according to your limit. With the help of extensive charts here, you can invest in Stocks, Mutual Funds, IPOs, ETFs etc. Recently Upstox Pro discontinued the Gold investment option in the trading app.

This app comes with zero commission on stock, and mutual funds trading. But you have to pay 0.05% or ₹20 whichever is lower for all intraday, F&O, commodities and currency orders.

Upstox Refer and Earn

The Upstox Pro app comes with a referral offer. If you want to earn money free by referring friends then you can take benefit of the ”Upstox refer and earn” offer. For a new referral, you will get a ₹200 in your Upstox wallet. If your referred friend opens their Upstox account then you will get a ₹100 and if they traded for the first time then you will get another ₹100 from them. Apart from these, you will also get ₹1000 brokerage credit to trade at ₹0 brokerage charges for the first 30 days.

Anytime you can withdraw your Upstox referral amount into your Bank account. They will take 2-3 days and after that, you will get paid by the Upstox team. If you are a blogger or YouTuber then you can join the Upstox Partner Program too.

2. Groww Trading App

If you are a beginner then the Groww app will be the best trading app for you. It is one of the simplest trading apps in India but so powerful. In terms of securities and processing, it is a really great app. You don’t have to pay any charges for Demat and Trading account opening.

There is two option available in the app such as Explore and Dashboard. In the explore tab you can check the advanced charts and check all the stock prices, top gainers, and top losers in one place. You can invest your money in stocks and mutual funds through the Groww app.

In this Groww app, there is no account opening or AMC Charges. You have to pay ₹20 or 0.05% (whichever is lower) per day for intraday, F&O, currency and commodity transactions. Apart from this, you can withdraw ₹50,000 or 90% of the total money invested per day.

Groww Refer and Earn

A lot of people use the Groww app to earn money by referring friends. You don’t need to invest your money but still, you can earn money from this app. If you have a lot of friends then you can simply refer them and earn money if they join through your link and open their Demat account on the Groww app. The person who will join through your link will get a ₹100 cashback and you will also get a ₹100 cashback in your Groww wallet. If you wish you can invest this money to buy stocks or mutual funds or you can withdraw it to your Bank Account.

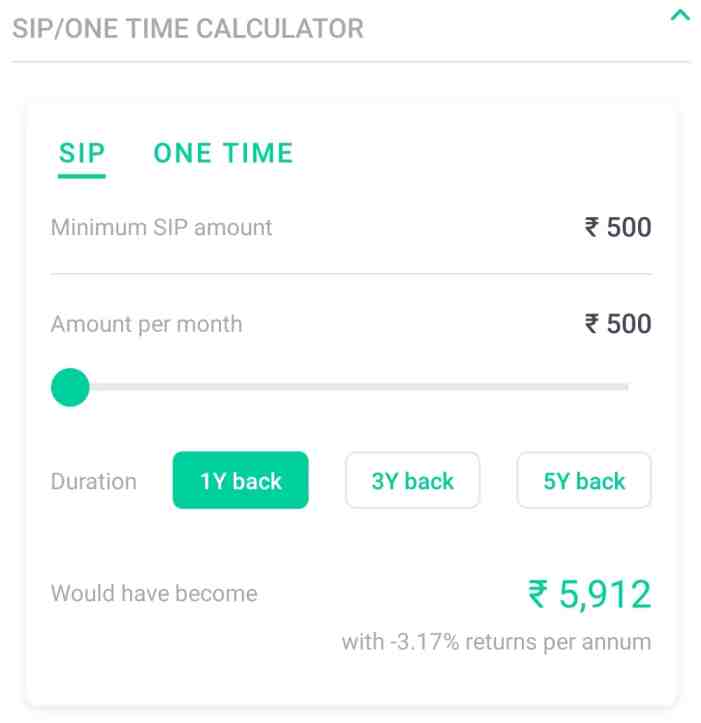

3. Paytm Money

This is another app for traders. If you want to start your investment journey online then you can start investing through the Paytm Money app. In this trading app, you can invest your money in Stocks, Mutual Funds, F&O, IPOs, NPS etc investment options.

You don’t need to pay any charges for Demat and Trading account opening. Also, they will not charge any AMC Charges from you. You have to pay ₹10 per order in F&O. Download the Paytm Money app and start investing in stocks, mutual funds, and NPS in 30 minutes.

Paytm Money Refer and Earn

As of now, Paytm Money doesn’t have a referral option in the app. But soon you will get to see the refer and earn option in the Paytm Money app. But if you invite your friends on Paytm Money through OneCode then you will get a ₹300 cashback for every new user.

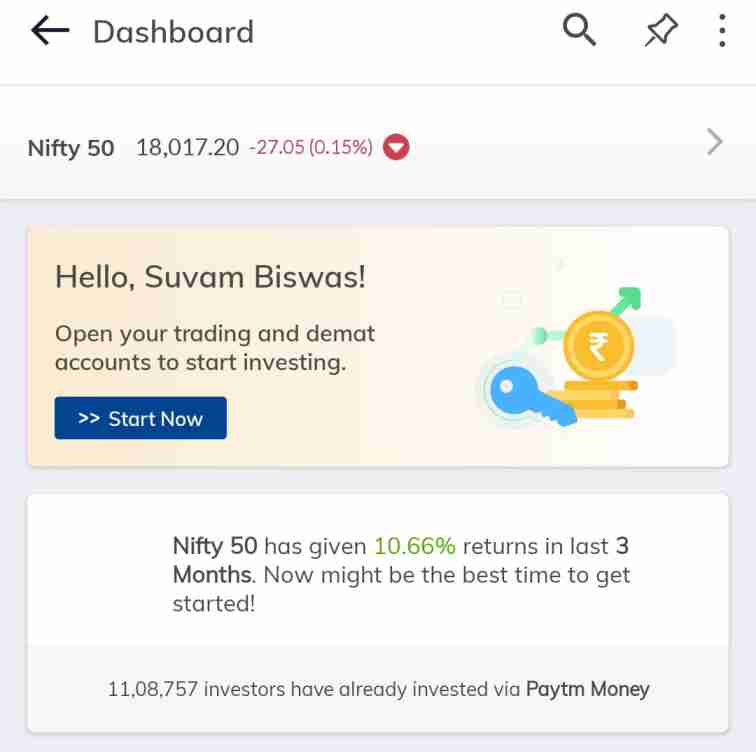

4. Zerodha Trading App

Many beginners, as well as pro investors, prefer this app for their first-choice trading app. I feel Zerodha is one of the best trading apps in India 2024. It comes with many interesting features and easy to understand the interface. This app is also known as Kite by Zerodha.

Zerodha does not ask you for any charges to open a Demat account here. After opening your Demat and Trading account on the Zerodha app you can open it by entering 6 digit pin. You can check all the stocks and charts in the watchlist tab. If you have invested money in the Zerodha app then all the shares will show on the portfolio tab. In this app, you can invest your money in stocks, IPO, SIP, and Mutual Funds investment options.

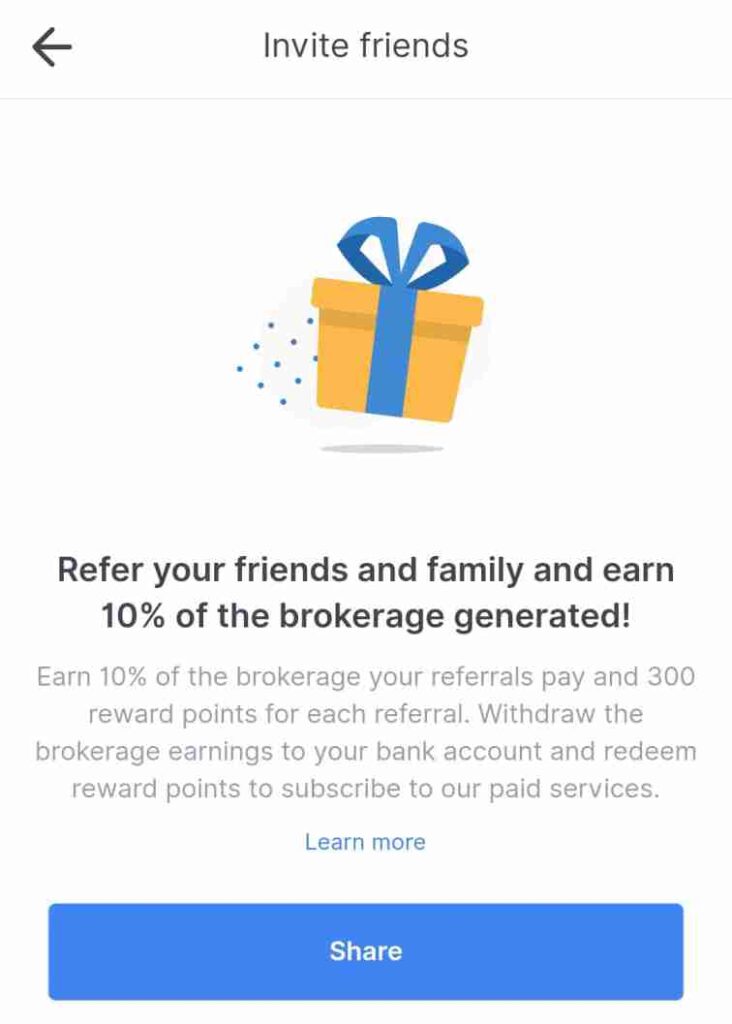

Zerodha Refer and Earn

If you want to earn brokerage sharing for a lifetime then you can use the Zerodha referral offer. If you refer your friends and family members to the Kite by Zerodha app then you will get 10% of the brokerage sharing for a lifetime. Also, you will get 300 reward points for each referral. You can withdraw the brokerage earnings to your bank account and redeem your reward points to subscribe to get their paid services.

5. 5Paisa Trading App

Another best trading app is 5Paisa. It has been with us for a long time. You can invest your money in this app on mutual funds, insurance, stocks, IPO, stock SIP, gold, IPO, loans and US stocks. In the app, you can check the live chart, Nifty 50, Sensex status and much more in a single click. On the margin calculator tab, you can check all stocks. Also, with the price alert option, you can set a price alert and sell stocks at the best time. I don’t think 5Paisa is one of the best trading apps in India because you have to maintain a ₹100 minimum balance and they will charge ₹30 charges every month.

5Paisa Refer and Earn

If you have some friends then you can earn free brand vouchers and up to 40% brokerage sharing for a lifetime. For the first referral, you will earn ₹500 in your 5Paisa wallet. After that, you will get 12.5%, 25% and up to 40% brokerage sharing if you refer up to 26+ friends.

6. IIFL Securities

This is another best trading app in India 2024. IIFL is a large financial service provider in India. It offers a wide range of services. IIFL Securities offers research-based advisory services for derivatives, commodities, currencies, IPO, loans, stocks etc.

You don’t pay any extra charges to open a Demat account on the IIFL Securities trading app. This is also one of the best trading apps in India that comes with zero account opening fees. For some segments, they will charge a flat ₹20 per order. Also, you have to pay AMC charges every year. The AMC charge is ₹200/year. Although you don’t have to pay for the first year.

IIFL Securities Refer and Earn

This trading app also comes with a referral offer. If you refer a friend then you will earn free gift vouchers. If your friends join through your IIFL Securities referral link and open their Demat account then you will get rewards of ₹500 for every successful referral.

7. ShareKhan Trading App

This is one of the oldest and the best trading apps in India for the past 21 years. It comes with a wide range of products that will help you to build a diversified portfolio. You can do market research with the help of its advanced charts feature. Your investment decisions will keep improving with its research reports option. There are no minimum deposits required in this app. You will get free learnings on stocks, and mutual funds within the app. With the ShareKhan trading app, you can’t trade globally. You have to pay 0.50% or 10 paise per share or ₹16 per scrip whichever is lower for equity delivery.

ShareKhan Referral Program

If you refer a new friend to the ShareKhan trading app then you will get a 15% brokerage commission for 1 year. To earn this commission your friend needs to complete their Demat account on this trading app and they need to trade in this app. The more they invest the more brokerage you will earn. Also, you will get 1-year of free access to TradeTiger (ShareKhan desktop trading platform).

8. SBI Securities

We all have trust in SBI. Many of us have a Bank account and a maximum of us have an SBI bank account. The SBI also has a trading app called SBI Securities. Here you can open your Demat and trading account and start investing. They have an option called ‘Knowledge Centre’ where you can read their blogs and watch videos related to stocks, mutual funds to improve your knowledge of investment. I feel it is a great option for beginner investors in India. They have a mobile app and web platform. You can download their app and start investing money online. The investment options are equity, derivatives, mutual funds, ETFs, insurance, fixed income, IPO, loans etc.

SBI Securities Refer and Earn

If you refer a new user to join the SBI Securities then you will earn up to ₹750 vouchers. To generate your unique referral link you have to enter your PAN number, and SSL employee code on the referral page. If your referred friend opens their Demat account through your link then you will get a ₹250 voucher. If your referred friends execute 3 trades from the new account within a period of 60 days then you will get another ₹500 from them.

Difference Between Intraday and Delivery Trading

Before searching for the best trading apps in India, you need to learn the basics of trading. Unless you have the basic idea you can’t make a profit through online trading. So it is better to learn about the basics of trading and the difference between Intraday trading and delivery.

Intraday Trading: If you buy shares and sell on the same day then it is called Intraday Trading. If you don’t sell then during the market closing time your shares will automatically be sold if you have bought shares as Intraday Trading. The net holding position for Intraday Trading is zero. Intraday Trading is also known as day trading. Basically, full-time traders use this method to make quick money. In this process, you can make a profit in a quick time. At the same time, you will lose money too. Intraday Traders often use a target price and then they sell their shares if their shares reach the target price.

Delivery Trades: In the Delivery Trade all your purchased shares will be added to your Demat account. You can hold shares for as long as you want. If you think then you can sell and make a profit on it. Yes, it is true that you can make a quick profit in Intraday Trading. But as compared to Intraday, Delivery Trading is a slightly low risky process.

How To Do Intraday Trading?

- First of all, open any trading app.

- Select any share.

- Then select quantity, price limit and type.

- Chose ”Intraday” from the Type option.

- Now tap on ”Buy”.

- Don’t forget to sell shares at the right time.

How To Do Delivery Trading?

- First of all, open any trading app.

- Select any share.

- Then select quantity, type and price limit.

- Chose the ”Delivery” option in the Type option.

- Now chose the ”Buy” option to buy shares.

- Hold shares and sell at the right time.

FAQs: Best Trading Apps

I started investing my money in 2019. Since then I have used many trading apps such as Upstox, Groww, Zerodha etc. Among these, I feel Zerodha and Upstox are the two best trading apps in India.

You can withdraw all your withdrawal balance. The minimum withdrawal balance of the Zerodha app is ₹100.

The minimum balance in 5Paisa is ₹100. Also, they will charge ₹30 every month as a charge.

If you refer a friend on Upstox then you will get ₹100 when they open their Demat account through your link. Also, you will get another ₹100 when they trade for the first time on the Upstox app.

You can earn money from the best trading apps by investing your money in Stocks, Mutual Funds, Gold, IPO etc. Also, if you refer a friend to some of the best trading apps like Upstox, Groww, Zerodha then you will earn real money and brokerage sharing for a lifetime.

I am from Bangladesh. City Dhaka.kya hum Bangladesh set withdraw kAr saktahu pls