Are you looking for the top 10 best Demat accounts in India 2024 list? If yes, then this article is for you. Today in this blog, I will discuss the top 10 best Demat and Trading accounts and apps in India 2024. Read this blog and find the best Demat accounts in India for you.

We all use the internet nowadays. As a result of the Internet, people do not learn many new things at home with the help of their smartphones. Online trading and investment are one of them. When there were no trading apps, investing in the stock market was not so easy. Now the matter is much easier and with the help of less time. We can analyze different companies from our home and buy its stock and make payments. We can also invest in mutual funds and IPO with the help of the best Demat accounts in India.

Online we can invest through Stock, Mutual Funds with the help of various apps and websites. Some of these apps are Upstox, Groww, Zerodha, Paytm Money etc.

Disclaimer- Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Best Demat Accounts in India

In this list, I have added the top 10 best Demat accounts in India 2024 list. You will find the best features from the best trading apps in India in the below list. Check all the mentioned details and find out the best suitable Demat accounts for you. If you refer a friend then you will earn real cash into your bank account too.

| Demat Accounts | Referral Reward |

|---|---|

| 1. Paytm Money | ₹300 |

| 2. Upstox | ₹600 |

| 3. Groww | ₹500 |

| 4. Zerodha | ₹300 + 10% Revenue Sharing |

| 5. IIFL Securities | ₹500 |

| 6. Angel One | ₹500 |

| 7. ICICI Direct | ₹600 |

| 8. 5Paisa | ₹500 + Upto 40% Revenue Sharing |

| 9. Bajaj Finserv | ₹450 |

| 10. Motilal Oswal | ₹1000 |

1. Paytm Money Demat Account

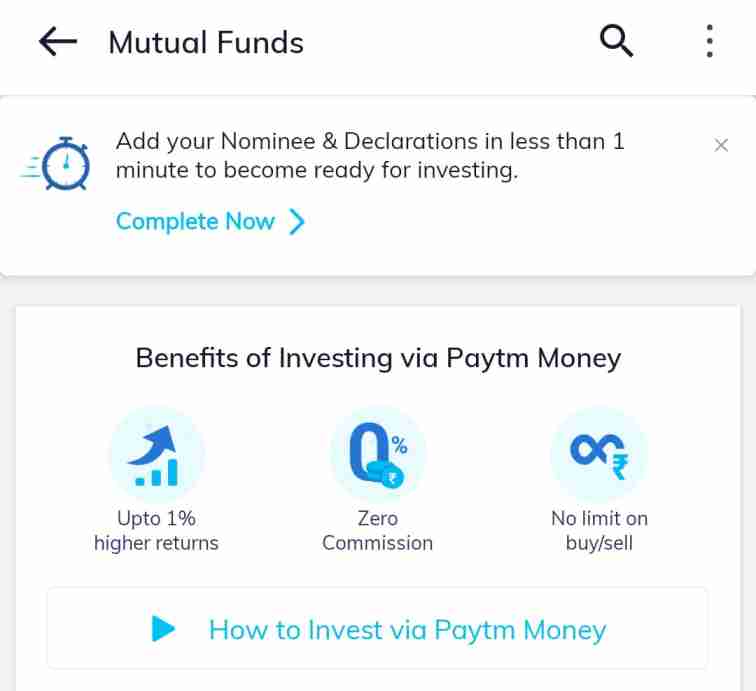

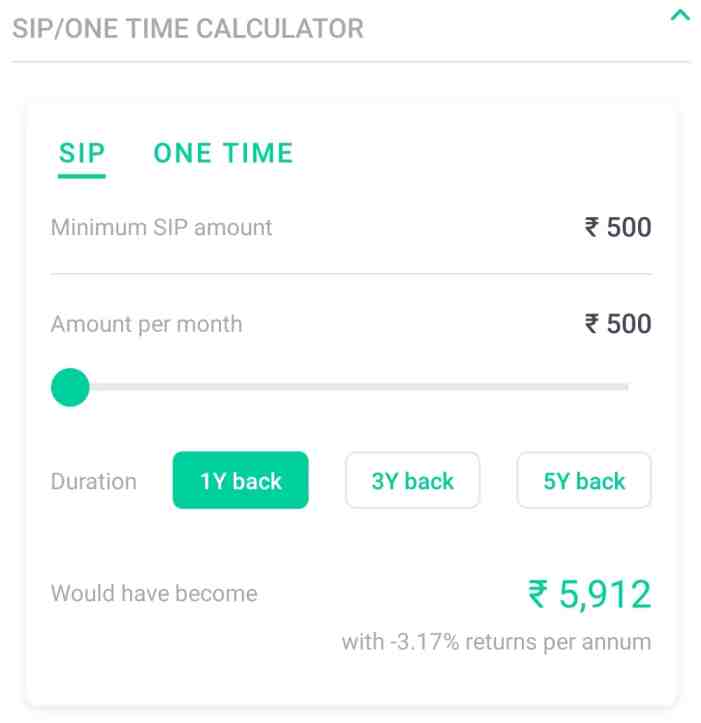

It is a new online investment option in the market. Paytm Money is a subsidiary brand of Paytm which is an RBI-approved Indian payment system. Users can invest their money into Paytm Money Stocks, Mutual Funds, IPO, NPS, F&O etc options.

It is a SEBI-registered stockbroker and investment advisor. They are also a partner of CDSL, NSE and BSE. Paytm Money offers many interesting features such as free equity delivery, minimum AMC charges, free Demat account opening and free mutual funds option. Paytm Money is a safe and secure investment option that comes with low-cost investing with a strong customer base all over India.

It comes with the official mobile app and website. Investors can open their Demat account and start investing online on its mobile app or website. It started as a direct mutual fund option later they added IPO, Stocks, Mutual Funds, F&O, and NPS options into it.

Paytm Money Features

- Zero commission direct mutual fund option.

- Many investment options like NPS, IPOs, F&O, Stocks, Mutual Funds etc.

- ₹0 account opening fee.

- ₹300 AMC (annual maintenance fee).

- Brokerage-free equity delivery.

- Intraday and F&O charges are flat ₹10.

- Online IPO application.

- Available mobile app and website.

- It supports 100% paperless account opening and a fully digital KYC process.

- KYC completes within 24 hours.

- You can set price alerts and create multiple watchlists to track real-time price changes of up to 50 stocks.

Refer and Earn in Paytm Money

Paytm Money does not run any direct referral offers. But they are working on it. Sooner or later you can refer a friend within the Paytm Money app and get rewarded with amazing gift vouchers or can earn free Paytm cash or real money in a Bank account.

As of now, you can use OneCode APK to refer a friend and earn money. They are offering a ₹300 referral reward for every new referral. You will get your money within 7 days after their successful account opening. You can withdraw your earnings into your Paytm bank account or any other bank account easily through the OneCode App.

Also Read: Start Affiliate Marketing with No Money

2. Upstox Demat and Trading Account

Upstox is by far the most investment app I have ever used. I like its user interface and processing system. If you are new and want to open a Demat account then I feel Upstox will be the best option for you. This is no doubt the best Demat accounts in India 2024.

Upstox is a Mumbai-based stock brokerage company that comes with low-investment options and a lot of interesting new features. They have three investment options mutual funds, stocks and digital gold. But recently they have removed the gold option from the app.

Upstox comes with zero commission on mutual funds, IPOs but you have to pay flat ₹20 or 0.05% (whichever is lower) for intraday. It is a fast, reliable and easy to use trading platform with paperless account opening.

Upstox Key Features

- It comes with free Demat account option.

- Flat ₹20 per trade or 0.05% intraday charges.

- Only 80% of the selling amount of Demat holdings will be available to trade on the same day. While the remaining 20% will be available to trade on the next day.

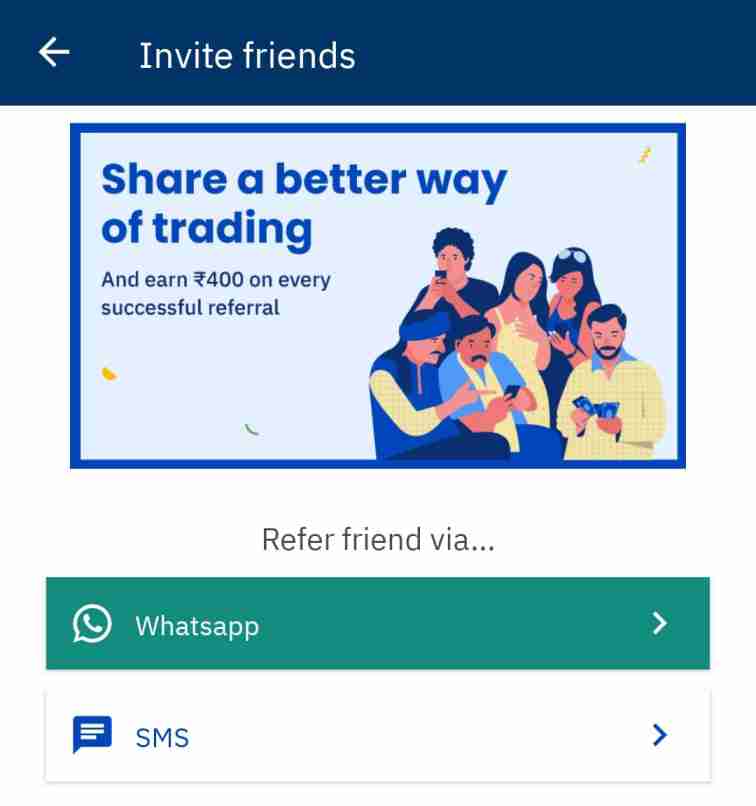

- Upstox comes with ₹400 refer and earn offer.

Refer and Earn Upstox

Upstox comes with a ₹600 refer and earn offer. If you invite a friend and they open a Demat account through your Upstox referral code then you will get a ₹300 into your wallet. After their first investment, you will get ₹300 more into your wallet. This is another reason why people think Upstox is the best Demat accounts in India that comes with a refer and earn offer.

- First of all, open your Upstox app.

- Tap on three lines.

- And now tap on the ‘Refer and Earn’ option.

- Share your referral link on WhatsApp or SMS.

- You can check your referrals on the ‘Your Earnings and Referrals’ tab.

Please note that you can withdraw your referral balance in your Bank account if you have traded at least one time in Upstox.

Also Read: Best Money Transfer Apps in India

3. Groww Demat Account

It is one of the oldest investment apps I have ever seen. In terms of user interface and easy understanding, I feel Groww is the best Demat accounts in India 2023. Any normal user who has some basic idea can easily use Groww from day one.

We can invest our money in Stocks and Mutual funds on the Groww app. There are two tabs explore and dashboard. We can get to see the top performing and top losers in the explore tab. Also, we can search stocks according to our choices. On the other hand from the dashboard tab, we can get to see our holdings and available stocks.

Groww app comes with a referral offer too. It varies from user to user. If you refer a friend then you will get a ₹100-₹300 cashback into your Groww wallet. This offer is only applicable to those users who have invested their money in the Groww app.

You can withdraw your referral reward and stock selling into your bank account. It will take some time. They charge ₹20 or 0.05% per executed charge.

Groww App Features

- Zero brokerage mutual funds option.

- Paperless online Demat account opening.

- It charges ₹20 or 0.05% for equity delivery and equity intraday.

- Zero account opening fee and zero demat AMC charges.

Refer and Earn Groww

- First of all, download the Groww app.

- Register and open your Demat account.

- Invest in Stocks (ex- ₹100).

- Now tap on the profile icon.

- Tab on the ‘Share and Earn Rewards’.

- Once they open their Demat account you will get ₹100.

Also Read: Best Money Making Apps

4. Zerodha Demat Account

You can also invest your money in the Kite with the Zerodha app. It charges flat Rs 20 or 0.03% (whichever is lower) per order. I feel after Upstox, it is one of the best Demat accounts in India for beginners. They offer three different mobile apps such as Zerodha Kite, Zerodha Coin and Zerodha Varsity. These three apps provide trading, mutual funds and stock market learning respectively. It is a low-cost investment option in our country India.

They have 120+ branches in more than 70+ cities in India. More than 22 lakh users are currently using Zerodha App. Zerodha is a member of CDSL, NSE and BSE.

Kye Features of Zerodha

- Brokerage-free equity delivery.

- Flat ₹20 or 0.03% charges for intraday and F&O.

- ₹200 Account opening fee (Offline account opening fee is ₹400).

- ₹300 Annual maintenance fee.

- Equity sell charges are 0.0025% on the sell side.

Zerodha Refer and Earn

Zerodha which is now one of the best Demat accounts in India also runs a referral offer. If you have some good friends who really want to invest their money in stocks, or mutual funds then you have a great chance to earn money. By referring friends you can earn ₹300 reward points and a 10% brokerage fee for a lifetime. You can withdraw this 10% brokerage fee to your bank account easily. And you can redeem your reward points to gain access to various tools and platforms in the Zerodha Universe.

Also Read: Money Earning Apps in India

5. IIFL Securities Demat Account

IIFL is one of the largest full-service stock brokers in India. It offers stock, mutual funds investment options in its app. IIFL Securities is a product of IIFL which is a financial service provider. They offer a flat-rate brokerage plan. It charges a flat ₹20 per executed order.

IIFL Securities does not charge any account opening fee but they charge ₹250 as an annual maintenance fee. They also run an amazing referral offer.

Key Features of IIFL Securities

- Free online Demat account opening.

- ₹250 for Demat account maintenance charges.

- ₹20 per executed order or for intraday and F&O.

- Brokerage free equity delivery.

- It also offers NRI Trading.

IIFL Securities Refer and Earn

IIFL Securities runs an interesting referral offer. If you refer a friend then you will earn a ₹500 gift voucher. But for this, the referral needs to complete their KYC and successfully open their Demat account in India on the IIFL app. You can check all your pending and successful referrals on its website. After that, you can redeem your ₹500 Amazon vouchers.

Also Read: Best Paytm Cash Earning Games

6. Angel One Demat Account

Angel One is also one of the most popular and best Demat accounts in India 2023. It is the third-largest stock broker in India. They have a large customer base and they come with a lot of interesting features. Angel Broking has its own mobile app and website. Recently they have launched their mobile app which is a good move by them.

I feel Angel One is the best Demat accounts for Intraday trading although it is my personal opinion. Angel One is a full-service broker that is a depository partner of CDSL and comes up with Equity, F&O, Commodity, Currency, Stocks, and Mutual Funds investment options.

Key Features of Angel One

- Free Demat account opening.

- Account maintenance charges are ₹240.

- ₹20 calls and trade charge.

- 0.25% equity, intraday, F&O, commodity brokerage.

- It provides full-service brokerage services at low brokerage fees.

- It offers free investment advisory and research tools to customers.

Angel One Refer and Earn

You can earn a free ₹500 gift voucher by referring friends. If your friend signs up through your link and opens their Demat account and trade on Angel One within 30 days then you will get a ₹500 voucher. You can redeem your gift vouchers on Amazon, Flipkart, Myntra or Big Bazaar. The more you refer the more gift voucher you will earn.

- First of all, open the Angel One referral page.

- Enter your client id and generate the link.

- Copy your invite link and share it with friends.

- Once your friend joins and trade you will get ₹500 gift vouchers.

Also Read: Play Games and Earn Money Online

7. ICICI Direct Demat Account

If you are an ICICI Bank customer then you can easily open your Demat account on ICICI Direct within a few steps. ICICI Direct is one of the best Demat accounts in India and a top brokerage company. It has also a large customer base all over India.

Users can avail of loans against Stocks. This is one of the best features of the ICICI Direct Demat account. Other Demat account providers do not come with this type of feature. It charges a flat ₹20 for intraday and F&O trading. You have to pay a ₹300 annual maintenance fee from the second year.

ICICI Direct Refer and Earn

If you refer a friend then you will get ₹600 for each successful referral. Normally, you will get ₹250 when your friend opens their ICICI Direct Demat account and ₹350 on your friend’s first transaction. At the same time, you can join the ICICI Direct affiliate program and can earn 35% revenue sharing for a lifetime. To earn 35% of the revenue you need to fill out a basic form. After that, they will contact you for further information.

8. 5Paisa Demat Account

This is not a popular stock brokerage like Upstox, Groww, Zerodha or any other leading provider in India. But it also provides some good features. You can open a free Demat account on 5Paisa without any cost. It has its own mobile app. They charge ₹20 per executed order. You have to pay ₹540 for the 5Paisa annual maintenance fee.

5Paisa Demat Account Refer and Earn

This is one of the best refer and earn offer providers in India. 5Paisa runs a very beautiful referral system. You can earn up to ₹750 and 40% revenue sharing for every referral.

The person whom you refer will also get a free Demat account and benefits worth ₹2100.

| No of Referrals | Club | Reward | Brokerage Sharing |

|---|---|---|---|

| 1st Referral | Star | ₹500 | 12.5% |

| 2 to 5 | Star | ₹250 | 12.5% |

| 6 to 25 | Elite | ₹250 | 25% |

| 26+ | Pro | ₹250 | 40% |

9. Bajaj Finserv Securities Demat Account

BFS (Bajaj Financial Securities) is a subsidiary of Bajaj Finserv. It is also one of the largest retail assets in India. You can open your free Demat account on Bajaj Finserv Securities and access it from anywhere. I like the quick account opening process of Bajaj Finserv.

BFS is also coming with a referral offer. Currently, there is no direct refer and earn option in the Bajaj Finserv. But you can refer friends through OneCode. If your friend signup and trade within the first 15 days then you will get ₹450 in your OneCode wallet.

10. Motilal Oswal Demat Account

Apart from Upstox, Groww or Zerodha, there is another popular Demat account in India which is Motilal Oswal. Motilal Oswal was founded back in the year 1987. It has more than 10 lakh users and it provides a wide range of financial services in India.

You can open a free Demat account in Motilal Oswal. It charges 0.05% brokerage charge for Intraday and 0,50% on delivery. Motilal Oswal will charge Rs 899 as annual maintenance charges. You can also pay ₹2500 one time to avoid AMC every year.

What is a Demat Account?

A lot of people think a Demat and a Trading account are the same. But it is not. There is a lot of difference between a Demat and a Trading account. A Demat account helps the investors to hold their shares in digital and electronic format. The full form of a Demat account is dematerialised account.

A Demat account in India is maintained by DP (Depository Participants). There are two DP’s that are NSDL and CDSL. A Demat account helps you to keep your all shares and mutual funds in one place. You can check all holdings in one place and the daily price difference.

Difference Between a Demat Account and a Trading Account

If a person wants to buy and sell shares online then they need both a Demat account and a Trading account. A Demat account helps investors to hold their stocks and mutual funds in one place. Whereas a Trading account helps investors to buy and sell shares. You can open a Demat account without a Trading account but can not open a Trading account without a Demat account.

Open a Demat Account

- First of all, open the opening form page.

- Tap on the register button.

- Enter your mobile number, email id and OTP.

- Now enter your basic details like name, address, basic details etc.

- Enter your PAN Card number and Bank details.

- Upload documents for KYC. (PAN Card, Bank statement or cancelled cheque).

- Upload a selfie or a short video clip of 5 seconds.

- Again upload your signature or e-sign with your Aadhar Card.

- After submitting the application, you will receive an SMS and mail.

- Your account will be activated within 24-48 hours.

Demat Account Required Documents

You need to upload some documents if you want to open a Demat account online or offline. For address proof, you have to upload your Aadhar, Voter, Driving License etc. Whereas for income and Bank proof, you have to upload a cancelled cheque, bank statement or first-page photo, PAN Card or Form 16. Also, you can provide your ITR acknowledgement or Demat account holdings details.

Apart from these, you need to upload a selfie or a 5-second video clip, signature or e-sign through Aadhar. These are the required documents to open a Demat account.

FAQs: Best Demat and Trading Accounts in India

A Demat account helps investors to hold their holdings (shares, mutual funds) in one place. You can check and track your all shares and mutual funds in one Demat account.

In India, a lot of the best Demat accounts in India are available. I feel Upstox and Zerodha are the two best Demat accounts in India.

You can open as many Demat accounts as you want. But the problem is you have to pay an annual maintenance fee for all Demat accounts. Apart from this, it is very difficult to track shares in many Demat accounts. So it is better to open one Demat account and hold shares in one place.

A Demat account helps investors to hold all shares and mutual funds in one place. Whereas a Trading account helps investors to buy and sell shares.

You can transfer money from the Demat account to a Bank account easily by tapping on the withdraw tab. It will take a few hours or days to reflect the funds back into your Bank account.

Simply tap on the sell option and select the quantity. After selling shares only 80% of the selling amount of Demat holdings will be available to trade on the same day. While the remaining 20% will be available to trade on the next day.