Do you want to open a Demat account in Zerodha Online 2024 but finding difficulties? Don’t worry today I will guide you with step by step process about how to open a Demat account in Zerodha online. This is a simple process but it will take some time.

Zerodha is a Bangalore-based discount broker. It offers investors to invest money in Stocks, Mutual Funds, IPOs, F&O etc. You have to pay some charge to open a Demat account in Zerodha. Also to open a Zerodha Demat account some basic documents are required.

There are two processes to open a Zerodha Demat account such as online and offline. Most of us like the online process because it is time-saving and easy to apply. Whereas the offline process takes a little more time than the Zerodha account opening online process.

It does not matter if you have a Demat account with another stockbroker but you can not open two Demat accounts in Zerodha with the same user details. Zerodha is a stockbroker registered with SEBI, BSE, NSE and MCX.

I feel Zerodha is a good option to start an investment online for beginners. It also runs a referral program. This will help users to earn more money in their bank account.

Zerodha Account Opening 2024

You can open a Zerodha account both online and offline. Zerodha was founded by Nithin Kamath and Nikhil Kamath in 2010. Most people like to apply online while some people like to apply offline. I like to apply personally online. A few days ago I opened Zerodha Demat Account online and it took me only 2 hours. The biggest advantage of applying online is that we don’t have to go anywhere. We can open a Demat and Trading account by uploading the necessary documents from our home.

Documents Required For Zerodha Account Opening

- ADHAAR Card with Phone number linked. You will receive an OTP in your AADHAR-linked number for eSign.

- PAN Card Linked with Adhaar Card.

- Bank account details such as IFSC Code, branch code and Account number. If you wish to activate the F&O segment then you will need additional 6 months Bank statement.

- You will also need to add a nominee since SEBI has made it mandatory. For this, you will need their ID Cards such as a masked Aadhar, voter ID and PAN Card. You can also add this later after creating an account, we have already shared how to add nominee in the Zerodha account after account creation.

Also Read: Best Demat Accounts in India

How to open a Demat account in Zerodha Online

- First of all, visit the Zerodha official website.

- Tap on the ‘Sign Up Now’ option.

- Enter your Mobile number and then tap on the Continue button.

- Enter the received OTP on your mobile number and tap on the Confirm button.

- Then enter your email id and verify it with the OTP.

- Now enter your PAN Card number and Date of Birth then accept and click on Continue.

- Pay Zerodha Account Opening Fee (Rs 200) via UPI, Net Banking, Debit or Credit Card.

- Sign in with Digilocker to share Aadhar details and tap on the Allow option.

- Enter your Bank account details and read all instructions.

- Then tick all the boxes and Continue.

- Now write the displayed OTP on a piece of paper and capture a video where your face and OTP should be visible (IPV).

- Upload all the required documents like Aadhar Card, PAN Card, Bank Proof (cancelled cheque, bank account statement), Signature proof and Income proof.

- Then enter OTP and complete design with Aadhar.

- Verify your Email with OTP.

- Review the application form and then click on Sign Now.

- Enter your Aadhar Number and OTP to complete the Zerodha Account Opening Online process.

Also Read: Upstox Refer and Earn

Zerodha Account Opening (Offline Process)

You can open Zerodha Demat’s account offline in two ways. Either you can request a callback from Zerodha or you can fill the form and courier it to their office address.

Simply visit Zerodha’s official website and then download the application form and fill the form. Then courier it to their office address with the required details and necessary documents photocopy. Fun fact, the Zerodha account opening fee is ₹200 online whereas you have to pay ₹400 for offline mode. Also, it will take more time than the online process.

Account Opening Form PDF

- First of all, visit the official website.

- Now scroll down and find the ‘Download and resources’ option.

- This option is available in the below section of the website.

- Here you will get to see a lot of options.

- Download the application form as per your requirements.

- Tap on the ‘Continue Offline’ option.

- Print the Zerodha application form PDF and fill it out.

Demat Account Opening Required Documents

- PAN Card.

- Aadhar Card linked with Mobile Number.

- Bank account proof (a cancelled cheque or latest account statement).

- Photo of a signature on a white paper.

- IPV (In-Person Verification).

- Income proof (Form 16, latest salary slip, last 6 months bank statement, Income Tax Return Acknowledgment, Demat holding statement, or Networth certificate).

Also Read: Paytm Money Review

Zerodha Demat Account Opening Charges

| Zerodha | Apply Mode | Charges |

|---|---|---|

| Demat & Trading Account | Online | ₹200 |

| Demat & Trading Account | Offline | ₹400 |

| Demat, Trading & Commodity | Online | ₹200 + ₹100 |

| Demat, Trading & Commodity | Offline | ₹400 + ₹200 |

Zerodha Charges

| Zerodha Demat Account | Charges |

|---|---|

| Brokerage | ₹0 |

| Intraday | ₹20 |

| Future & Options | ₹20 |

| Mutual Funds | Zero Commission |

| Equity Intraday, F&O | 0.03% or ₹20 per executed order (whichever is lower) |

| DP Charges | ₹13.5 + 18% GST |

| 1. Anauual Maintainance 2. Quarterly Charges (Individuals, HUFs, NRIs and partnership firms) | ₹300 + 18% GST ₹75 + 18% GST |

| 1. Anauual Maintainance 2. Quarterly Charges (Corporates, i.e. LLPs and private & public companies) | ₹1000 + 18% GST ₹250 + 18% GST |

| GST | 18% |

| SEBI Charges | ₹10 / Crore |

How To Buy Shares in Zerodha

In order to buy shares in Zerodha, you need to open a Demat account in Zerodha. If you don’t know how to open a Demat account in Zerodha online then read the above process. By following the above process you can open your Zerodha Demat and Trading account online.

- First of all, open the Kite by Zerodha app.

- Search or select any shares from the Watchlist option.

- Select any Share and then choose the Buy option.

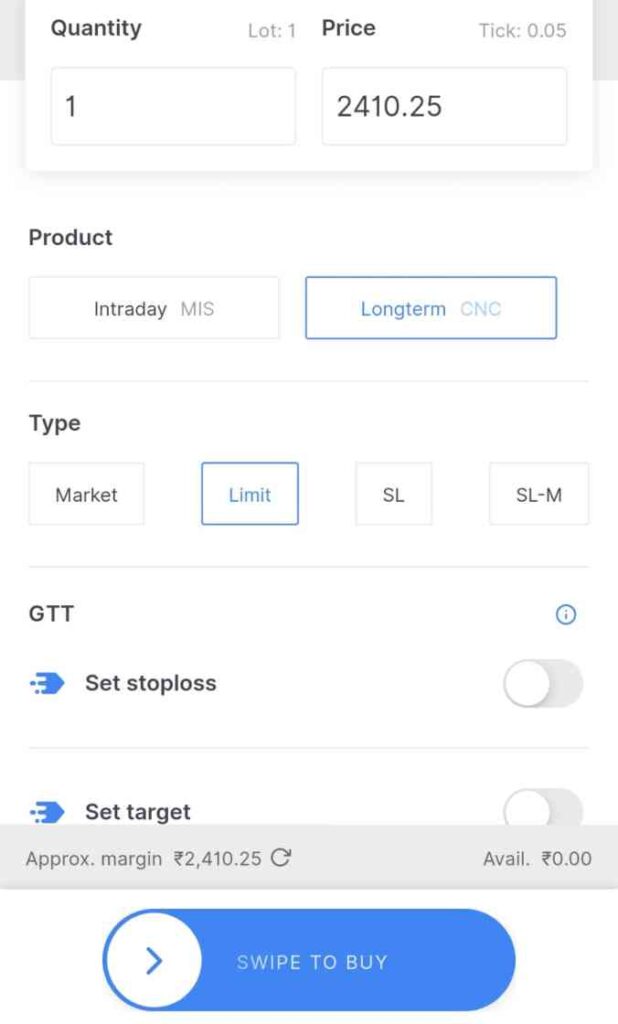

- Enter Quantity and price.

- Then choose Intraday (MIS) or long-term (CNC).

- You can choose between Market, Limit, SL or SL-M option.

- Also, you can choose the GTT options (Set Stoploss and Set target).

- Now click on the ‘SWIPE TO BUY’ option.

- Make payment through your funds.

- You can not buy shares if you don’t have funds in your account.

- So in case if you are seeing any ‘Rejected’ message then first add funds and then buy shares within the price limit.

Also Read: Groww App Refer and Earn

Add Funds in Zerodha

- First of all, tap on the user id or profile option.

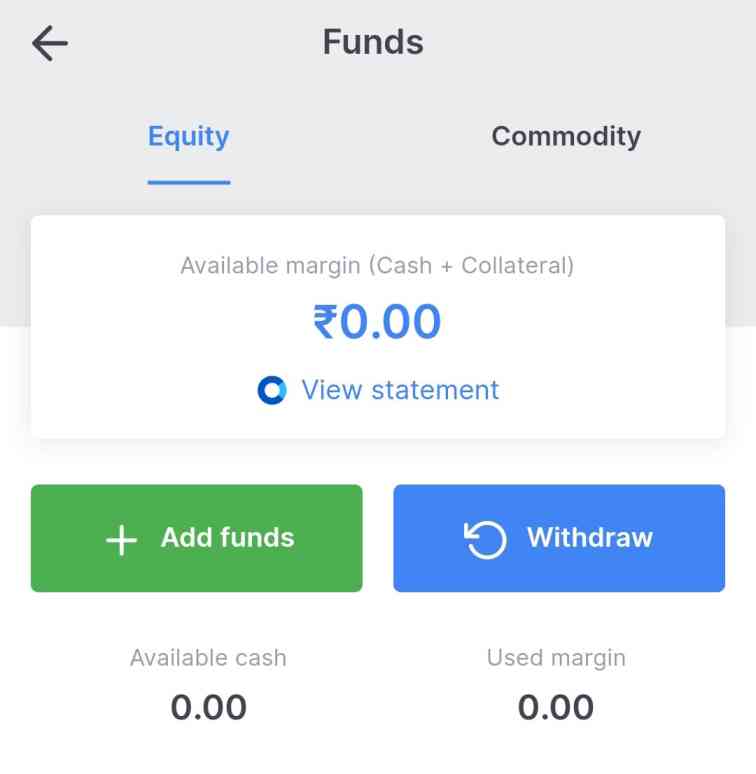

- Now tap on the ‘Funds’ option.

- Tap on ‘Add Funds’ option.

- Enter the amount and make payment through a selected bank account.

- You can also make payments through UPI, Net Banking or other options.

How To Withdraw Money from Zerodha

First of all, open your Kite by Zerodha App or Zerodha official website. You can withdraw money from the Zerodha app or website. Both of the ways are mentioned below.

- First of all, open the Kite by Zerodha app.

- Click on your User ID or profile option.

- Tap on the Funds option.

- Tap on the Withdraw option and enter the amount to withdraw.

- Now tap on proceed and then choose the Confirm button.

If you wish you can cancel the withdrawal request any time by tapping on the ‘cancel withdraw’ option. If you have added money to your funds then you can not withdraw the money on the same day. Also, you can not withdraw money more than the mentioned withdrawal balance. In this way, you can transfer money from your Zerodha account to your Bank account easily.

Important Terms in Zerodha

| Zerodha | Full-Form |

|---|---|

| BSE | Bombay Stock Exchange |

| NSE | National Stock Exchange |

| CDSL | Central Depository Services |

| NSDL | National Securities Depositories Ltd |

| PoA | Power of Attorney |

| IPV | In-Person Verification |

| GTT | Good Till Triggered |

| CNC | Cash and Carry |

| MIS | Margin Intraday Square Off |

| IOC | Immediate or Cancelled |

| IPO | Initial Public Offering |

| TOTP | Time-Based One Time Password |

| LTP | Last Traded Price |

| AMO | After Market Orders |

| SLM | Stop Loss Market |

| BO ID | Beneficiary Owner Identification Number |

| NRML | Normal Order |

| ETF | Exchange-Traded Fund |

| MCX | Multi Commodity Exchange |

| NCDEX | National Commodity and Derivative Exchange |

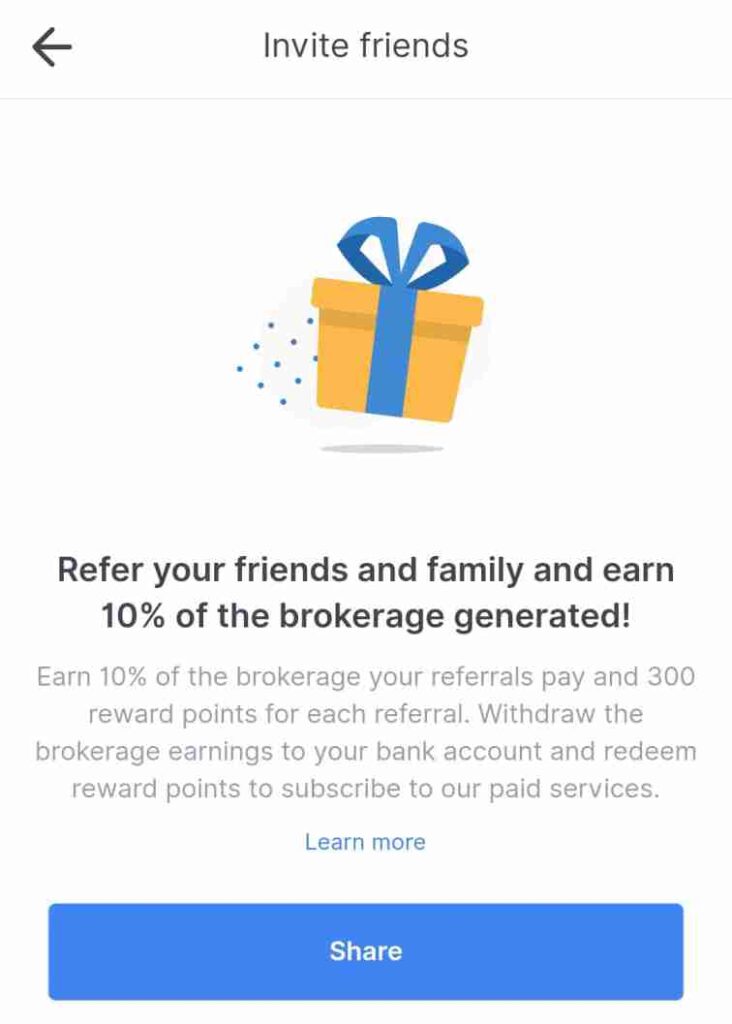

Zerodha Refer and Earn

You can earn money from Zerodha without any investment by referring friends. If you refer your friends and family then you will earn 10% of the brokerage lifetime and 300 reward points. You can withdraw this 10% brokerage earned through referral into your Bank account.

- First of all, open the Kite by Zerodha app.

- Tap on the user id or profile option.

- Now choose the ‘invite Friends’ option.

- Simply tap on the share option.

- Share your Zerodha Referral Code with friends.

- Once they open their Zerodha Demat Account and trades you will earn 10% brokerage fee.

Also Read: Start Affiliate Marketing with No Money

FAQs: Demat Account in Zerodha

The full form of IPV in Zerodha is In-Person Verification. It means you have to capture a video by writing the code on a piece of paper where your face and the code should be visible correctly.

Yes, I feel Zerodha is a really good option to start investing online for beginners. Zerodha app comes with an easy-to-understand interface and a lot of interesting features.

The full form of GTT is Good Till Triggered in Zerodha.

A CDSL TPIN will help you to sell your shares. It is a 6-digit password authorized by Zerodha. By entering your BO ID and PAN Number on the CDSL Website you can generate your TPIN. The TPIN will be sent to your email linked with Zerodha.

The full form of CNC in Zerodha is Cash and Carry.

The full form of MIS in Zerodha is Margin Intraday Square Off.

The full form of IOC in Zerodha is Immediate or Cancelled.