Welcome friends, I hope all of you are safe and fine. Today in this article, I will guide you to transfer MobiKwik wallet to bank transfer process and charges. This is a very simple and easy process. You can transfer your MobiKwik wallet balance to your Bank account within a few minutes from your MobiKwik App.

As you all know MobiKwik is an online payment application. We can use MobiKwik to transfer money from one bank to another, UPI payments, recharge & bill payments, investment & insurance etc.

Anyone can transfer a MobiKwik wallet balance to a bank account from the MobiKwik app. But in this case, you have to pay charges. Don’t worry, today I will tell you about the MobiKwik wallet to bank transfer without charges process too.

MobiKwik Wallet To Bank Transfer Process

If you search the internet for MobiKwik wallet to bank transfer then you may find many methods. Today I will tell you about the two methods. With the help of which you can transfer your MobiKwik wallet balance to your bank account.

If you use the free method then you need another app besides MobiKwik. And that app is Zeta App. If you use this method, you will be able to make a bank transfer to your wallet balance free.

And here is the rest of the official method, which many of you may know. Where you can easily transfer wallet balance bank only through MobiKwik App. In this case, you have to pay some charges which are very little. These money transfer charges depend on how much wallet balance you are transferring.

How To Transfer Money From MobiKwik Wallet To Bank Account

- First of all, update and open the MobiKwik App.

- Tap on the Wallet To Bank Transfer option.

- Tap on transfer to a new account.

- Now select any option between Account Number and UPI ID, and fill the form.

- Enter Beneficiary Name, Account Number, IFSC Code or UPI ID only.

- Tap on Continue.

- Enter amount (must be equal or more than ₹50).

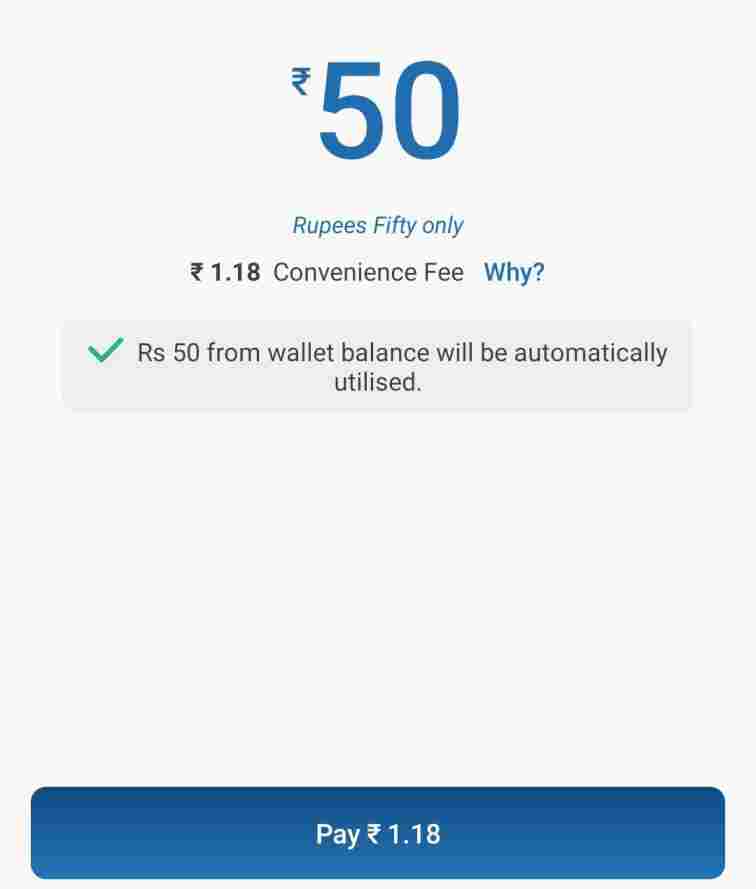

- Please remeber you have to pay some charges for it. If the extra money has not added on your MobiKwik wallet then you can pay the extra amount and transfer MobiKwik wallet to Bank.

Wallet To Bank Transfer Charges

As per the MobiKwik rule, you have to pay a processing fee or charges to transfer money from your wallet to the bank. It’s because whenever you try to transfer your added or loaded money, MobiKwik has to pay a fee to the bank each time.

If you are a MobiKwik KYC user then you have to pay a processing fee or IMPS fee that is 3.15% + GST. So if you are a KYC user and will try to transfer ₹1000 then you have to pay ₹31.50 + GST = ₹37.17.

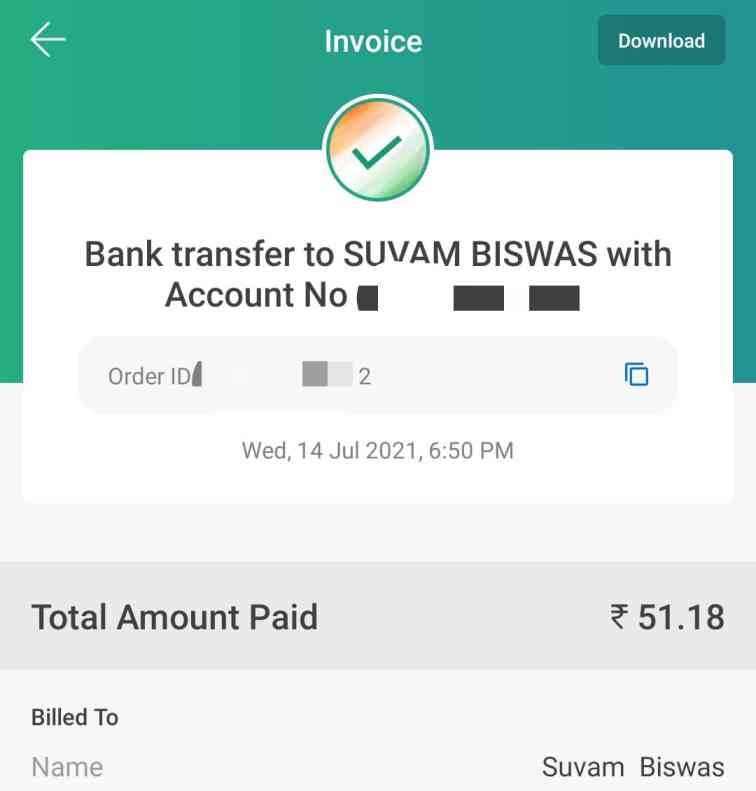

As you can see on the above image, I have transferred ₹50 from MobiKwik Wallet to Paytm Payments Bank and I have to pay ₹51.18 for this. The remaining ₹1.18 is the processing fee or IMPS fee that I have paid for the wallet to Bank transfer of amount ₹50.

Transfer Limits

You can transfer your MobiKwik wallet to the bank or a payments bank. You can make the daily transfers of amounts ₹100000, ₹50000 and ₹10000 to a normal bank, payment bank and a non-registered account respectively. If you are sending money to a non-registered account then the account or UPI ID will be registered after 30 mins from the time of the first transfer.

| Normal Bank | Payments Bank | Non-Registred Account |

|---|---|---|

| Daily Transfer Limit: ₹100000 | Daily Transfer Limit: ₹50000 | Daily Transfer Limit: ₹10000 |

| Daily Total Transfers: 10 | Daily Total Transfers: 5 | Daily Total Transfers: 5 |

| Monthly Transfer / Beneficiary: ₹100000 | Monthly Transfer / Beneficiary: ₹70000 | Monthly Transfer / Beneficiary: ₹10000 |

| Monthly Total Transfers: 50 | Monthly Total Transfers: 50 | Monthly Total Transfers: 30 |

Transfer MobiKwik Wallet Balance To Bank Account Without Charges

You can transfer your wallet balance to your bank account without charges too. In this case, you have to install another application apart from MobiKwik. The app name is Zeta App. First of all, download and register on the Zeta app and then follow the below process.

- First of all, open the MobiKwik App.

- Verify your MobiKwik wallet with Aadhar Card and Pan Card and complete KYC.

- Apply your MobiKwik Super Visa Card.

- Now open Zeta Wallet App.

- Register and complete KYC on Zeta Wallet App.

- Now add money to your Zeta Wallet through the MobiKwik Super Visa Card.

- After that, transfer the added money to your bank account.

Wallet To Paytm Transfer

Do you know you can transfer the MobiKwik wallet balance to your Paytm wallet too? Yes, you heard it right. You can transfer money in a tricky way. To do this you have to follow the above tricks. You can transfer your wallet balance to your Bank account with or without any charges method. once the money will be credited to your account, you can easily add the amount back to your Paytm wallet. Apart from this, there is no direct way to transfer money from MobiKwik wallet to Paytm wallet. This method is a free method, so don’t worry about it.

Refer and Earn

MobiKwik recently re-launched the referral offer. If you will refer your friends and if they make the first UPI payment from your link then you will get ₹20 cashback in your MobiKwik wallet.

- First of all, open the MobiKwik App.

- Tap on All Services.

- Scroll down and find the Offers For You tab.

- Here you will get to see the Refer & Earn option.

- Tap on Share via WhatsApp and share your invite link with friends.

Add Money To MobiKwik Wallet

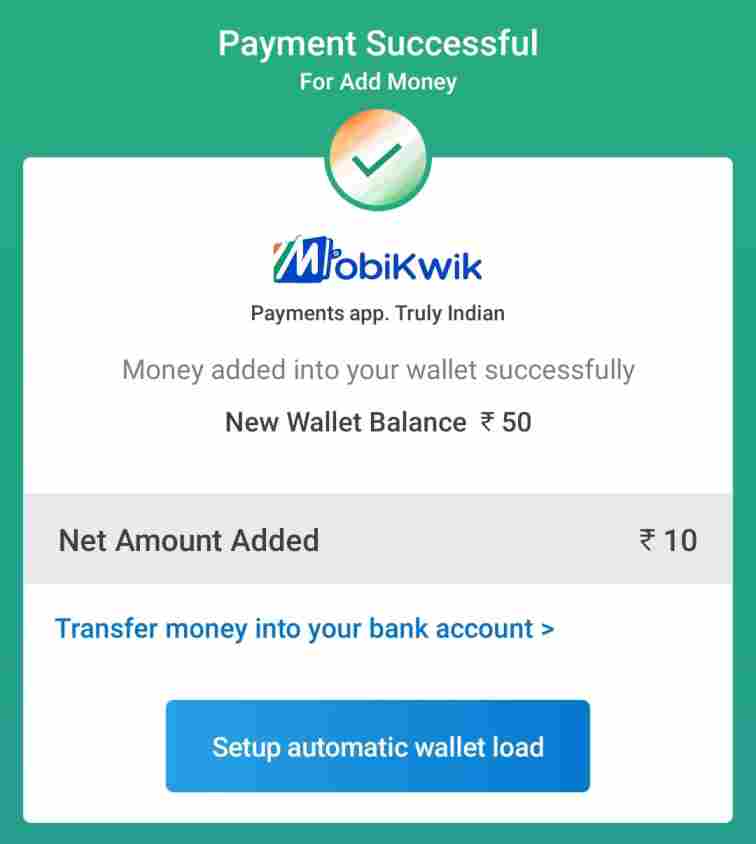

Anyone can easily add money to MobiKwik wallet within a few simple steps. You can add money to your MobiKwik wallet using UPI, Debit or Credit Card. Sometimes you will get supercash or cashback offers too.

- Open the MobiKwik App.

- Tap on the profile icon.

- Now select the Add Money.

- Enter Amount and tap on Continue.

- Apply add money offers if applicable.

- Make payment and check your wallet.

Questions Related To MobiKwik Wallet

You can easily transfer your wallet balance to your bank account. I have mentioned two ways that can be used to transfer wallet balance. If you follow the official method then you have to pay the IMPS fee + GST on the money transfer.

Yes, you can transfer your MobiKwik wallet money to your Bank account. It is a very simple process. Simply open the MobiKwik app and tap on the wallet to bank transfer option. After that add your bank details and enter the amount to transfer money from your wallet to the bank account.

If you are a KYC user, then you have to pay an IMPS fee to transfer money from the MobiKwik wallet to the bank. In this case, you have to pay 3.15% + GST. For example, if you transfer ₹1000 then you have to pay ₹1037.17 including charges.

Anyone who is a KYC user on MobiKwik can transfer money. If you are a non-KYC user then IMPS transfer is not allowed as per RBI guidelines.

First of all, open the MobiKwik app and then tap on the profile icon. After that, tap on add money and enter an amount. Make payment and the money will be credited to your account.

Is MobiKwik is really safe? We can link our bank account?